Click here for printer friendly PDF format

Attorney Sydney M. Halloran reviews challenges and techniques for addressing cryptocurrency in divorce cases.

In recent years, cryptocurrency (“crypto”) has become a mainstream component of personal finance that has increasingly appeared in divorce cases as part of the marital estate. As digital currencies like Bitcoin, Ethereum, and countless others are more and more common in divorce cases in Massachusetts and beyond. This shift necessitates that legal professionals and divorcing individuals alike understand the unique nature of cryptocurrency and the novel challenges it presents when dividing marital property.

Crypto refers to digital assets that function as a medium of exchange but exist only in electronic form on decentralized networks. Instead of relying on banks or governments, cryptocurrencies use blockchain technology – a distributed ledger maintained by a network of computers – to record transactions securely. Crypto values often fluctuate dramatically due to market demand.

For more general information on crypto check out this article by Charles Schwab: What is Cryptocurrency and How Does It Work?

Family courts generally treat cryptocurrency like any other property for divorce purposes: if acquired during the marriage, it’s subject to division between spouses. However, the unique characteristics of crypto – from its digital-only form to its volatility and pseudo-anonymity – introduce new complexities that divorcing couples and their lawyers must address. This blog will explore these challenges, delve into the methods for conducting discovery of cryptocurrency assets, and outline best practices to ensure equitable outcomes in divorce settlements.

Crypto Challenges in Divorce Cases

High-net-worth divorces in Massachusetts already involve complex asset division, and the presence of cryptocurrency can further complicate the process.

The Elusive Nature of Tracking Transactions: One of the primary difficulties in dealing with cryptocurrency in divorce is the challenge of tracking transactions. The decentralized structure of cryptocurrencies means they lack a central authority that maintains records, unlike traditional banks. Unlike a bank account, crypto holdings don’t produce regular account statements or easy paper trails. Many cryptocurrencies are held in digital “wallets” identified only by cryptographic keys, which are often known only to the owner. This means it can be hard for anyone besides the holder to determine how much cryptocurrency exists and where it’s stored.

If a spouse is uncooperative, uncovering these assets may involve piecing together indirect evidence—such as credit card purchases or transfers to a cryptocurrency exchange. Moreover, the pseudo-anonymous nature of blockchain transactions can make it difficult to link accounts to individuals without specialized analysis. This inherent opacity requires specialized techniques and expertise to trace and identify cryptocurrency assets.

The Rollercoaster of Speculative and Volatile Value: Cryptocurrency prices are notoriously volatile. For instance, Bitcoin's value often undergoes massive swings within a short period. A digital coin might be worth $30,000 today and $60,000 or $10,000 a few months from now. This extreme volatility complicates asset division, because the value of the marital estate can swing wildly over the course of the divorce litigation. Parties and courts must decide on a valuation date – for instance, the date of separation, the date of trial, or an agreed-upon date – and stick to it, or else risk an inequitable distribution due to price changes. The speculative nature of cryptocurrency makes its long-term value is uncertain, making it challenging to determine a truly equitable division that accounts for potential future gains or losses.

Complexity in Asset Division: The legal classification and division of cryptocurrency assets add another layer of complexity to divorce settlements. While most jurisdictions now recognize cryptocurrency as property subject to division, the practicalities of dividing it can be complex. The intangible and technical nature of crypto also complicates how it’s divided. Transferring cryptocurrency requires careful technical steps (and any mistake – like sending to the wrong wallet address – may be irreversible). Some spouses may also claim that cryptocurrency has been “lost” – for example, by losing the private key or password to a wallet – rendering the asset inaccessible. The emergence of other digital assets like Non-Fungible Tokens (NFTs) introduces further complexities, as these unique digital items cannot be simply divided and often require appraisal or a buy-out agreement.

Overall, typically the most difficult issue to address when dealing with crypto in divorce will be dealing with discovering the assets themselves and then valuing them.

Conducting Discovery in Crypto Divorce Cases

Uncovering cryptocurrency in a divorce often requires creativity and diligence in discovery. Unlike traditional assets, there is no monthly statement arriving in the mail for a Bitcoin wallet. Attorneys must therefore look for indirect evidence of crypto activity and use the legal tools at their disposal:

Utilize the Supplemental Probate and Family Court Rule 410 – Mandatory Self-Disclosure

This rule requires that the parties exchange copies of specific financial documents and information within 45 days of after service of the summons and Complaint for Divorce occurs. It is important that both parties have access to all of the important financial documents relevant to their case. Traditional financial records can reveal crypto dealings. For example, bank statements might show deposits or withdrawals related to a cryptocurrency exchange.

Leverage Tax Documents: The IRS now pointedly asks taxpayers whether they have engaged in any virtual currency transactions on their Form 1040. Analyzing tax returns and associated schedules can uncover previously undisclosed crypto trades (for instance, Schedule D and Form 8949 will list capital gains from cryptocurrency sales). Also, U.S.-based exchanges may issue 1099 forms reporting certain crypto income; for example, Coinbase provides a 1099-MISC for users who earn over $600 in rewards.

Tax documents can serve as an initial yet crucial step in uncovering cryptocurrency holdings during divorce proceedings. Analyzing these documents can help identify potential discrepancies or inconsistencies in a spouse's financial disclosures, potentially indicating undisclosed cryptocurrency holdings.

Find Crypto Purchases in Bank and Investment Accounts: Another common method for locating crypto assets involves the careful review of bank and investment account statement for signs that a party is depositing funds into crypto (or receiving cash from crypto transactions). Although crypto itself may be secretive, most crypto investors fund their crypto accounts from fairly conventional sources, like bank and investment accounts. If the party is using a crypto trading platform like Coinbase, it is often possible to find transactions transferring funds in and out of the platform in conventional account statements.

Subpoena Exchanges and Online Platforms: One challenge in crypto discovery is that there’s often no central bank or authority to subpoena for records if assets are held in personal wallets. However, many people use major cryptocurrency exchanges (like Coinbase, Binance, or Gemini) to buy or hold crypto. These companies maintain customer records and will respond to subpoenas or court orders in most cases. An attorney can subpoena account information and transaction histories from such exchanges, much as one would subpoena traditional bank records. Be aware that you may need to send multiple subpoenas if the spouse has accounts on several exchanges or has moved assets between platforms.

Challenges can arise when dealing with international or unregulated exchanges, as they may not be subject to US legal jurisdiction and therefore may not comply with subpoenas. The information obtained through subpoenas can include detailed transaction histories and current account balances. Understanding the legal procedures for issuing and serving these subpoenas is crucial for effective discovery.

Engage Experts: Given the technical complexity of cryptocurrency, attorneys often bring in specialized experts to assist with discovery and valuation. In fact, the rise of Bitcoin and other digital assets in divorces has created an entirely new job category of forensic investigators who focus on finding hidden crypto stashes. . Forensic accountants are skilled at tracing financial transactions and can follow the digital footprints of cryptocurrency on the blockchain to uncover hidden assets. Cryptocurrency experts possess in-depth knowledge of blockchain technology, digital wallets, and the intricacies of cryptocurrency transactions, enabling them to assist in both discovery and accurate valuation. Their expertise is invaluable in providing crucial evidence and ensuring a fair assessment of these digital assets.

In conducting crypto discovery, attorneys should cast a wide net. It often requires combining traditional discovery (financial affidavits, interrogatories, subpoenas, document requests) with tech-oriented sleuthing.

Best Practices for Addressing Crypto in Divorce

Navigating the complexities of cryptocurrency in divorce requires a comprehensive understanding of the unique challenges these digital assets present. The difficulties in tracking transactions, the volatility of their value, and the intricacies of their legal classification and division necessitate a diligent and informed approach. Best practices emphasize the paramount importance of full financial disclosure by both parties. Engaging forensic accountants and cryptocurrency experts is often essential to uncover hidden assets and obtain accurate valuations. Furthermore, legal professionals and divorcing individuals must be aware of the evolving legal precedents and consider the potential tax implications associated with the division of these assets. By embracing transparency, employing specialized expertise, and carefully considering the various legal and financial strategies available, it is possible to achieve fair and equitable outcomes in divorce cases involving cryptocurrency, ensuring that the digital age does not compromise the principles of justice in family law.

Treat cryptocurrency like any other significant asset when it comes to preservation. In Massachusetts, for example, an automatic financial restraining order takes effect when a divorce is filed. This order prohibits either party from transferring, concealing, or dissipating assets—including crypto. Courts take a dim view of attempts to hide or misrepresent crypto holdings during litigation.

Cryptocurrency may be a modern innovation, but in the context of divorce, it requires the same diligence, transparency, and legal scrutiny as any other asset. Attorneys must be proactive, informed, and prepared to use both traditional and technical strategies to ensure a fair outcome.

Considerations for Dividing Cryptocurrency Assets

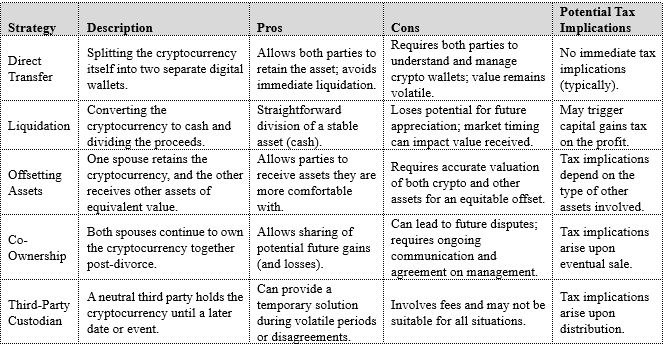

When dividing crypto assets in a divorce, it’s important to consider tax consequences, as well as the practical concerns of parties. Given crypto’s volatile nature, it is sometimes important to one or both parties to convert the crypto into cash quickly. In other cases, parties may want to continue holding the asset in crypto form. Options for assigning crypto assets pursuant to the division of assets include:

Listen to an AI-Generated Podcast of this Blog

Lynch & Owens is proud to partner with Google Notebook LM to provide podcasts based on our original blogs using Google’s Deep Mind artificial intelligence technology.

DISCLAIMER: The views and opinions expressed in the podcast are based on the blog you are reading but often include perspectives and opinions that differ from the blog's original content and do not reflect the views of the blog author. This blog and the Google Notebook LM podcast are offered for informational purposes only and are not legal advice. If you have a legal issue involving this subject matter, please consult with a qualified attorney.

About the Author: Sydney M. Halloran is a Massachusetts divorce lawyer and family law appellate attorney for Lynch & Owens, located in Hingham, Massachusetts and East Sandwich, Massachusetts.

Schedule a consultation with Sydney M. Halloran today at (781) 253-2049 or send her an email.