Click here for printer friendly PDF format

Child Support Just Increased For High Earners In MA. Does It Impact Your Case?

Biggest changes to 2021 Guidelines impact families with multiple children, high earning parents, and parents with substantial childcare costs.

In October, the 2021 Massachusetts Child Support Guidelines became law, along with a new worksheet used to calculate child support. As noted in our prior blog, there are several major changes under the 2021 Guidelines, which may impact your child support order. These changes include an increase of the previous “cap” of $250,000.00 for calculating support, increasing the calculation when there are multiple children, and increasing the allocation of the childcare cost.

Parents in Massachusetts may wish to review their current child support orders with an attorney to see whether the changes under the 2021 Guidelines affect their child support case, and how.

Child Support Increases for High-Income Parents in MA

For higher earnings parents, the biggest change under the 2021 Guidelines may be the increase from the previous “cap” of $250,000 in combined annual income used to calculate support, which increased to $400,000 per year under the 2021 Guidelines. For example, under the 2018 Child Support Guidelines, a non-custodial parent earning $400,000 per year would pay maximum presumptive child support of $780 per week (if the custodial parent earned no income and neither party had deductible medical/childcare costs). Under the 2021 Guidelines, the same parent would now pay $1070 per week in presumptive child support.

Under the previous Guidelines, a judge had discretion to order child support on the parties’ combined income exceeding $250,000. Depending on the case, Massachusetts Probate & Family Court judges sometimes exercised their discretion to order above-Guidelines support; however, judges frequently declined to do so. Effective October 4, 2021, the new combined parental income limit per year is $400,000.00—an approximate increase of 33% for parents who are high-income earners. Where ordering child support on the parties’ combined annual income up to $400,000 is now presumptive, a judge must enter findings of fact justifying a downward deviation to a lower order.

If you have an existing child support order, it may be important to review the basis of the order to determine whether it was based on combined income of more than $250,000 at the time of the order. Similarly, it may be worth considering whether combined income has increased beyond $250,000 per year since the order entered. If the 2021 Guidelines would generate a significant increase in presumptive child support based on the current combined incomes of the parties in your case, a Complaint for Modification may be justified.

Child Support Increases for Parents with Multiple Children in MA

Another major change under the 2021 Guidelines impacts parents with multiple children. Under the 2018 and prior Guidelines, a custodial parent with two children received an automatic 25% increase in child support compared to a similarly situated parent with one child. A parent with three children would receive 38% more child support than a parent with one child, and a parent with four children would receive 45% more child support than an identical parent with one child.

The 2021 Guidelines significantly increase the “multiplier” used for additional children. Instead of increasing child support by 25% for parents with two children, the 2021 Guidelines provide a 40% increase in child support for parents with two children. Under the 2021 Guidelines, a parent with three children receives 68% more child support than a parent with one child, and a parent with four children receives 85% more child support than an identical parent with one child.

The effect of the increase in child support for parents with multiple children can be dramatic. A child support order of $500 per week for two children under the 2018 Guidelines would now be $560 per week under the 2021 Guidelines. Likewise, a child support order of $500 per week for three children under the 2018 Guidelines would now be $608 per week under the 2021 Guidelines. However, for parents earning more than $400,000 in combined annual income, the increased multipliers for multiple children can have even greater impact on child support.

Suppose you are a non-custodial parent of two children earning an annual salary of $400,000, whose child support was set at $965 per week in 2020. Under the 2021 Guidelines, your child support obligation could increase to $1,498 per week based on two primary factors: (1.) the increase of the “cap” from $250,000 in combined income to $400,000 and (2.) the increased multiplier for a second child from 25% under the 2018 Guidelines to 40% under the 2021 Guidelines. Although many cases may see only minor differences in calculations between the 2018 and 2021 Guidelines, cases involving high-income parents with multiple children may generate child support increases of greater than 150%. Of course, specific circumstances for each family will factor into the calculations, such as whether the family has significant childcare or medical insurance premiums or expenses.

Marked Increases in Child Support for Parents with Child Care Costs in MA

Perhaps the single most dramatic change under the 2021 Guidelines arises out of the credit that parents may now receive for childcare costs. Under the 2018 Guidelines, parents shared in the combined costs of childcare or medical insurance for the parties. However, the 2018 Guidelines included a 15% cap that limited the impact of such costs on child support. (Specifically, the 2018 Guidelines only allowed child support to change by 15% based on childcare/medical costs. For example, for a case involving child support of $100 per week, the 15% cap under the 2018 Guidelines meant that child support would only increase/decrease by a maximum of $15 per week for childcare/medical costs.) The 2018 Guidelines’ 15% cap meant that parents with hefty childcare or medical insurance costs for their children received only a limit benefit in the child support calculation.

The 2021 Guidelines replace the 15% cap on childcare costs with an uncapped cost sharing approach. In practice, this means that if one parent earns 80% of the combined income, and the other parent earns 20% of the combined income, then the parent earning 80% of the combined income will be responsible for 80% of the parties’ combined childcare costs. For cases featuring a significant disparity in incomes between the parties, along with a substantial childcare cost for either party, the impact on child support can be dramatic.

The 2021 Guidelines impose some restrictions on the childcare apportionment. For example, childcare costs are limited to $355.00 weekly per child for childcare that is necessary for a parent to be gainfully employed, including training or education. To calculate each party’s respective share for childcare costs, the 2021 Guidelines Worksheet accounts for:

- The number of children requiring childcare

- The total weekly cost of childcare for each child

- Each party’s proportional share

Although the calculation is fact specific, it is fair to say that a parent who earns 90% of the combined income may be responsible for 90% of the other parent’s childcare costs, up to $335 per week per child. In some cases, this may result in hundreds of dollars per week in increased or decreased child support.

In addition to implementing full cost sharing for childcare costs, the 2021 Guidelines decreased the impact of medical insurance premiums in the child support calculation. For that reason, parents can expect very different treatment under the 2021 Guidelines for childcare costs vs. medical insurance costs, with childcare costs having a major impact on child support and medical insurance premium costs having a far smaller impact moving forward.

Possible Downward Deviations When Child Support Exceeds 40% of a Payor’s Gross Income

As noted above, for parents with one child, combined income of less than $250,000 per year, and no substantial childcare costs, the changes under the 2021 Guidelines may have very little impact on the child support calculation. However, for parents with multiple children, combined income of more than $250,000 per year, and/or substantial childcare costs, the changes to the 2021 Guidelines could have a dramatic increase on child support, including increases of greater than 150% compared to child support under the 2018 Guidelines.

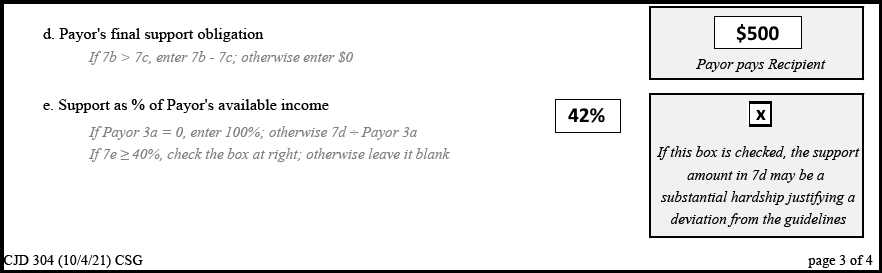

In recognition of the possibility for dramatic increases in child support under the 2021 Guidelines, the Child Support Task Force added a new box to page 3 of the 2021 Guidelines Worksheet that seeks to alert judges of a possible financial hardship to the payor when the child support order exceeds 40% of the payor’s pretax income:

Caption: Boxes 7(d)-(e) of the 2021 Child Support Guidelines Worksheet

It is important to note that the 2021 Guidelines do not “cap” child support at 40% of a payor’s gross income. Instead, the worksheet merely flags such child support for judges, who must then determine whether a deviation from the presumptive child support order is appropriate. About this issue, the 2021 Guidelines state:

Judges should continue to consider deviation where appropriate, especially where the overall current child support order is more than 40% of the payor’s available income as listed in Line 3a of the guidelines worksheet. See Section IV. C. Line 7e of the guidelines worksheet indicates whether the overall support order is more than 40% of the payor’s available income.

Although a downward deviation is far from guaranteed, Boxes 7(d)-(e) of the 2021 Child Support Guidelines Worksheet provide a new tool for attorneys and payors to argue that the amount of child support places a substantial hardship on the payor that warrants a downward deviation in child support.

Will These New Guidelines Impact Your Bottom Line?

As noted throughout, the changes to the 2021 Massachusetts Child Support Guidelines can have a dramatic impact on child support in cases with specific attributes (multiple children, combined income over $250,000, childcare costs, etc.) while having very little impact on other cases. In evaluating whether the 2021 Guidelines are likely to change child support in a given case, it is important to always remember that changes in either party’s income (e.g. an increase in income since the last time child support was calculated), family structure (e.g. one or more child has become emancipated since the last time child support was calculated), or other financial changes (e.g. one party’s alimony obligation beginning or ending since the last time child support was calculated) can have an even greater impact on child support than the changes to the Guidelines.

The best way to find out how and if your family will be affected is to meet with a qualified Massachusetts family law attorney.

About the Author: Nicole K. Levy is a Massachusetts divorce lawyer and Massachusetts family law attorney for Lynch & Owens, located in Hingham, Massachusetts and East Sandwich, Massachusetts. She is also a mediator for South Shore Divorce Mediation.

Schedule a consultation with Nicole K. Levytoday at (781) 253-2049 or send her an email.