Massachusetts family law attorney Jason V. Owens discusses multiple errors affecting the 2017 Massachusetts Child Support Guidelines.

As the product of a closed and secretive process, it probably isn’t a surprise that the 2017 Massachusetts Child Support Guidelines contain a critical error. Unless changes are made to the 2017 Guidelines, this error is likely to complicate and confuse parties, judges and attorneys in thousands of child support cases for parents who share physical custody in Massachusetts over the next four years.

As we recently blogged, the 2017 Guidelines incorporate an ambitious new approach for crediting parents with substantial medical and child care costs in the child support calculation. However, the new medical and child care credits result in glaring errors when applied to shared physical custody cases in which parents share parenting time equally.

In many shared custody cases, the error in the 2017 Guidelines will seriously distort the child support calculation. Here’s the rub: the 2017 Guidelines erroneously double the generous new medical/child care credit in shared custody cases. Thus, a parent with shared custody and a medical insurance expense of $100 per week is likely to see his or her child support change by $130 per week. In effect, this parent is being paid$130 for incurring a $100 expense.

The error in the 2017 Guidelines does not dramatically affect child support in every shared custody case. For parents with relatively low incomes and minor medical insurance and child care costs, the distortion is less dramatic. However, in higher income shared custody cases, even relatively modest medical and child care deductions result in serious distortions of the final child support order.

UPDATE (10/3/17): Another error (#2) has been detected in the 2017 Guidelines that affects the adjustment for medical/child care. Read more in the update below.

UPDATE (10/5/17): The Child Support Task Force is reportedly reforming to address and fix errors in 2017 Guidelines. Read more in the update below.

UPDATE (10/6/17): Yet another error (#3) has been detected in the 2017 Guidelines, this time affecting the calculation for children over 18. Read more in the update below.

Table of Contents for this Blog:

- 2017 Guidelines Double Count Credits for Medical and Child Care Payments in Shared Custody Cases

- A 15% Problem: How a 15% Cap on Medical and Child Care Expenses Complicates the Error

- Fixing the Error: How to Properly Apply the Medical and Child Care Credit in Shared Custody Cases Under the 2017 Guidelines

- The 2017 MA Child Support Task Force: A Closed and Secretive Process Results in Mistakes

- (UPDATE 10/3/17) New Error in Guidelines Detected by Attorney Gabriel Cheong of Infinity Law Group

- UPDATE 10/5/2017: Fixes Reportedly Coming for Errors in Massachusetts 2017 Child Support Guidelines

- UPDATE 10/6/17: More Errors in 2017 Guidelines Identified for Children Over 18 Years Old

2017 Guidelines Double Count Credits for Medical and Child Care Payments in Shared Custody Cases

The error is as obvious as it is serious. As we detailed in our blog earlier this month, the Guidelines include a serious effort to provide parents with substantial medical insurance and child care costs with credit within the child support Guidelines formula. By and large, these efforts succeed when it comes to cases not involving shared custody:

In general, the 2017 Guidelines have greatly improved the fairness of how Massachusetts calculates child support when parents have substantial child care or health care coverage.

In Massachusetts, the Guidelines calculate child support for parents with shared (50/50) custody using the following method:

Where two parents expect to or do share equally, or approximately equally, the financial responsibility and parenting time for the children, the child support order shall be determined by calculating the guidelines worksheet twice, first with one parent as the recipient, and second with the other parent as the recipient. The difference in the calculations shall be paid to the parent with the lower weekly support amount.

In short, in order to calculate child support in shared custody cases, Massachusetts perform the Guidelines with each parent as the custodial parent. Child support is based on the difference between the two orders.

Here’s the problem: When medical and child care credits are calculated using this method, the same parent receives the credit twice. If the 2017 Guidelines give one parent a $30 credit for his or her child care costs, then calculating the Guidelines twice for shared custody means that the parent will receive the $30 credit in both calculations, resulting in a total credit of $60 for that parent.

The error is almost elegant in its simplicity. In every shared custody calculation under the 2017 Guidelines, the medical and child care credit calculated in Box 4(g) of the worksheet is doubled. Unfortunately, fixing the error is more complicated than simply cutting the credit in half in every case.

A 15% Problem: How a 15% Cap on Medical and Child Care Expenses Complicates the Error

One way to understand the nature of the error to note that the 2017 Guidelines cap the adjustment for medical/child deductions at 15% of the overall order (“The combined adjustment for child care and health care costs is capped at fifteen percent of the child support order.”) Thus, if a base child support is $200 per week, the 15% cap limits the adjustment to $30/wk. When the 2017 Guidelines are applied to shared custody cases, the party receives the adjustment twice. This sends the adjustment in many shared custody cases rocketing past the 15% cap.

As we noted in our first blog on medical/child deductions under the 2017 Guidelines, the purpose of the 15% cap is avoid wildly skewed child support orders:

The adjustment to child support for child/medical costs is capped at 15% of the overall child support order. In order to avoid scenarios where child support becomes wildly skewed due to one party’s very high child care or health care costs, the Guidelines limits the adjustment. In short, if the base child support order is $100 per week, the adjustment for child/medical costs will be no more than $15 upwards or downwards.

It is simply inconceivable that the Task Force intended for parents in primary custody scenarios to have the protection of the 15% cap while leaving parents with shared custody exposed to massive and arbitrary adjustments that often exceed the actual medical/child expenses incurred.

However, the 15% cap creates problems when it comes to resolving the error in the 2017 Guidelines. In shared custody cases involving parents who earn substantially different incomes, one side of the shared custody equation may be affected by the 15% cap (i.e. when the lower earning parent is the payor), while the adjustment is unaffected by the cap in the second calculation (i.e. when the higher earning parent is the payor).

In practical terms, this means that double-counting error affecting shared custody calculations under the 2017 Guidelines cannot be fixed by simply cutting the medical and child care credit in half. In cases where the 15% cap applies to one side of the calculation but not the other, cutting the credit in half would simply lead to confusion. Unfortunately, this means that fixing the error requires a more nuanced approach.

Fixing the Error: How to Properly Apply the Medical and Child Care Credit in Shared Custody Cases Under the 2017 Guidelines

Fixing the calculation error in the 2017 Guidelines for shared custody cases is either simple or complicated, depending on one’s level of sophistication. For attorneys and judges, the fix will likely take some getting used. For self-represented parties, the fix below is likely to be rather challenging to compute.

The four steps for resolving the calculation error are as follows:

- Run the Child Support Guidelines with each party as custodial parent.

- Instead of using the Adjusted Weekly Support amount in Box 5(b), the initial child support order should be calculated using the Payor’s Share of Support in Box 3(f) of the worksheet for each party. The difference between Box 3(f) in each calculation is the initial child support order.

- After calculating the initial child support order, then apply the adjustment for child care and health care costs found in Box 4(g) of each worksheet. If Box 4(g) is different for each calculation, then the credit should be higher of the two calculations.

- However, the final credit must not exceed 15% of the initial child support order calculated in Step 2.

The method above is unlikely to be perfect. There may be instances where applying the higher credit from Box 4(g) may prove problematic. In general, however, the method above ensures that parents in shared custody arrangements receive the benefit of the medical and child care credit found in the 2017 Guidelines while avoiding the problem of either parent receiving a double credit.

For many attorneys and litigants in shared custody cases, applying the medical and child credit from the 2017 Guidelines simply won’t be worth the time and effort required to perform the math. For them, a simpler alternative is available: calculate child support for shared custody cases using the 2013 MA Child Support Guidelines formula.

A Simpler Approach: Using the 2013 Guidelines to Calculate Child Support in Shared Custody Cases

The simplest approach to resolving the error in the 2017 Guidelines is by applying the 2013 Child Support Guidelines. There are couple of ways to do this. The first way is for parties to simply submit 2013 Child Support Guidelines Worksheets.

As we detailed in our blog about the medical and child care credits in the 2017 Guidelines, one of the main criticisms of the 2013 Guidelines was how the 2013 calculation gave far larger credits for medical insurance and child are expenses incurred by child support payors compared to child support recipients. In other words, under the 2013 Guidelines, a child support payor paying $100 per week in medical expenses would see a noticeable reduction in his or her child support obligation, while a child recipient paying $100 per week in medical expenses would see almost no increase in his or her child support received.

It is important to note, however, that the unequal treatment of medical/child credits for child support payors vs. recipients under the 2013 Guidelines was generally less of a problem in shared custody cases? Why? Because calculating child support in shared custody cases requires two calculations – with each party serving as the child support payor in one calculation. The 2013 Guidelines clearly advantaged child support payors when it came to medical/child credits, but with both parents filling the role as payor in the shared custody equation, the problem of inequality was generally reduced.

With these general principles in mind – and the more basic reality that the 2013 Guidelines do not contain any glaring errors when it comes to medical/child credits in shared custody cases – it makes a lot of sense for litigants in shared custody cases to simply ignore the 2017 Guidelines and use a 2013 Guidelines Worksheet to calculate child support in their case.

Not Every Judge Will Agree to Ignore the 2017 Guidelines in Shared Custody Cases

Of course, not every judge or opposing attorney will be willing to ignore the existence of the 2017 Child Support Guidelines in a shared custody case. In cases where litigants are forced to use the 2017 Child Support Guidelines Worksheet, it is important to understand how the 2013 Guidelines calculation can be extracted from the 2017 Guidelines worksheet. Indeed, knowing how to extract a 2013 calculation from a 2017 worksheet is especially important if you must convince a judge that the 2017 Guidelines are broken for shared custody cases.

How to Extract the 2013 Calculation from the 2017 Worksheet in Most Cases

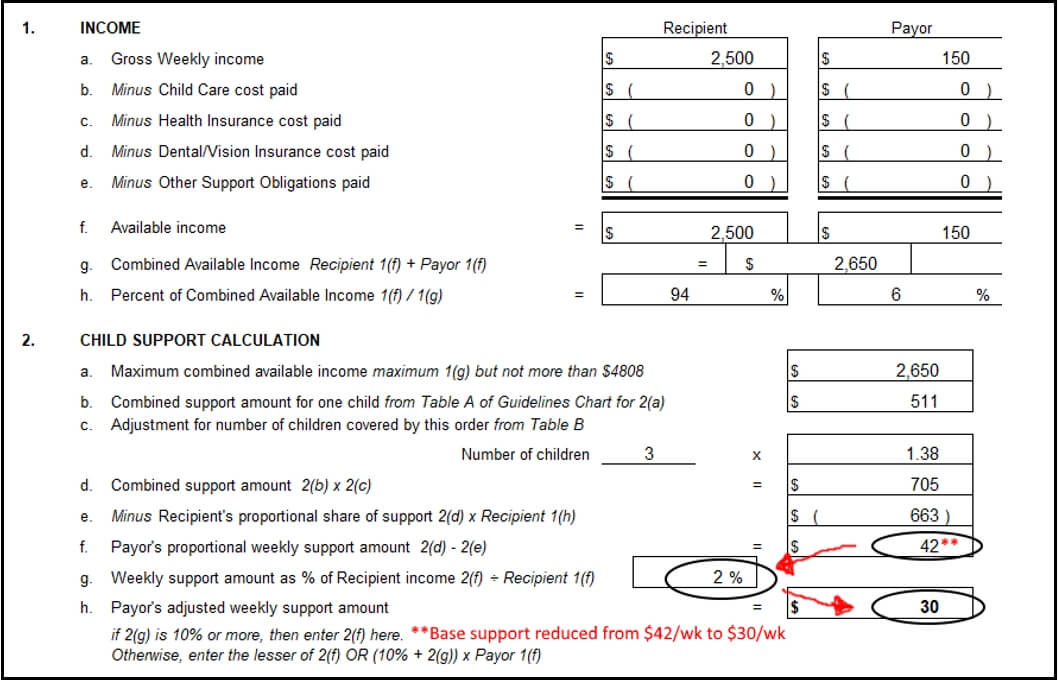

Box 3(f) of the 2017 Guidelines worksheet matches Box 2(f) of the 2013 Guidelines worksheet. Box 3(f) in the 2017 Worksheet is labeled “Payor’s Share of Support” and Box 2(f) of the 2013 worksheet is labeled “Payor’s Proportional Share of Support”, but rest assured, these two boxes are identical in every way. The data inputs for the two boxes are the same, as is the math used to fill the box.

In both worksheets, the “Payor’s Support” box represents the basic child support order that a payor will usually end up paying. Thus, a party can look at Box 3(f) of the 2017 worksheet and see what the child support order would have been under the 2013 Guidelines. Being able to extract a 2013 Guidelines order from a 2017 worksheet is especially helpful when your task is to show a judge or opposing attorney just how broken the 2017 Guidelines are when it comes to shared custody cases.

(Here’s a sample argument, free of charge: “Judge, look at Box 3(f) on the worksheet in front of you. That’s what child support would have been under the 2013 Guidelines. Compare the 2013 figures with final child support for the 2017 Guidelines in Box 5(b). See the problem? One party receives the same credit twice for medical/child costs! The amount of the credit is more than the actual medical/child cost!”)

In short, using a 2017 worksheet to illustrate what child support would have beenunder the 2013 Guidelines is an effective way to illustrate how broken the 2017 Guidelines are in shared custody cases.

What’s the Catch with Using Box 3(f) of the 2017 Worksheet to Calculate a 2013 Order? (There’s Always a Catch.)

Part of what makes the error in the 2017 Guideline so severe is that there are no clean, easy fixes. Applying the 2017 medical/child credit in only one direction is possible, but it is a complex multi-step process. Using a 2013 Guidelines worksheet means convincing a judge or an opposing lawyer to literally ignore the 2017 Guidelines. Similarly, using Box 3(f) of the 2017 worksheet to calculate a 2013 order is an imperfect solution.

As I said above, in most cases, Box 3(f) of the 2017 worksheet is an exact match for the final child support order on a 2013 worksheet. There are two exceptions:

(a.) Minimum Weekly Orders Increased from $18/wk to $25/wk. The 2017 Guidelines increase the minimum child support from $18 per week under the 2013 Guidelines to $25 per week under the 2017 Guidelines. Thus, if the child support payor earns little or no income, then Box 3(f) of the 2017 worksheet will now read $25/wk instead of $18/wk. This discrepancy is minor, and in most cases, the $7/wk difference in minimum orders will not matter. If you are trying to generate an exact replica of the 2013 Guidelines using then Box 3(f) of the 2017 worksheet, however, it’s important to know that the slightly higher minimum order might be skewing your math.

(b.) The Rarely Used Box 2(g) of the 2013 Guidelines. Unfortunately, there is a second, more nuanced issue when it comes to using Box 3(f) of the 2017 worksheet to generate a 2013 child support order. The problem, so to speak, is Box 2(g) of the 2013 Guidelines. Here is the rule under the 2013 Guidelines: if a weekly child support order is less than 10% of the recipient’s weekly income, the amount of child support may drop. It sounds confusing, I know, but the idea underpinning the rule is fairly simple: if the party receiving child support already earns a lot of money, then he or she has less need for child support. Thus, if the child support order in Box 3(f) is less than 10% of the custodial parent’s overall income, then the final child support order is bumped downward.

Here is the rule in action:

In reality, a reduction in final child support under the 2013 Guidelines due to Box 2(g) is exceedingly rare. But every now and again, it’s a factor. And when it occurs, the final child support order ends being slightly lower than what you see in Box 3(g) of the 2017 worksheet.

Details like this are precisely the reason why the error in the 2017 Guidelines is so problematic. Each “fix” includes exceptions and complexities that the 2017 Child Support Task Force should have addressed in the 18 months they were working on the 2017 Guidelines. Unless the 2017 Guidelines are amended, or the official 2017 worksheet significantly revised, the onus will fall on parties, lawyers and judges to avoid the glaring error at the center of the 2017 Guidelines in shared custody cases.

The 2017 MA Child Support Task Force: A Closed and Secretive Process Results in Mistakes

A wise headline writer once said, you can’t understand something you hide. The same can be said about the 2017 Child Support Task Force. As we blogged in July, the Massachusetts Child Support Task Force is so clothed in secrecy that we only knew the identities of 3 of the Task Force’s 12 members the month before the final Child Support Guidelines were announced. (Trust me when I say we consider it our business to know these things, but even we could not crack the code of silence surrounding the 2017 Task Force.)

Good governance requires transparency and public participation. Governments who conduct their business in secrecy, outside the public eye, make mistakes. It goes without saying that there are hundreds (if not thousands) or Massachusetts attorneys who would have happily beta tested the 2017 Child Support Guidelines if the calculation had been made public before being finalized. Instead, this is what happened: after announcing the new Guidelines on July 18, 2017, the Massachusetts Trial Court Department did not release an official Child Support Guidelines worksheet until one week before the 2017 Guidelines became effective on September 15, 2017.

The 2017 Guidelines became the law of Massachusetts a mere 11 days ago. In less than two weeks, Massachusetts attorneys and parties have discovered a glaring flaw in the Guidelines that could have been easily fixed had the Trial Court simply released a working Guidelines worksheet a month or two before the Guidelines became the law.

In 2021, the Trial Court would be well served to use its greatest resource – the attorneys and citizens of Massachusetts – to test the next Child Support Guidelines before they are final, instead of shielding the drafting process behind closed doors and secrecy. The rest of the world calls this crowdsourcing, and it works. Crowdsourcing is a really good way to avoid embarrassing errors by using transparency and openness as a tool rather than sources of fear.

(UPDATE 10/3/17) New Error in Guidelines Detected by Attorney Gabriel Cheong of Infinity Law Group

A recent blog by Attorney Gabriel Cheong of Infinity Law Group uncovers a new error in the 2017 Guidelines, which (again) affects the adjustment for medical coverage and child care costs:

We could go into the details about what we believe is happening but it would be a lot of hyper-technical detail, so we’ll stick to what matters: if line items 4(d) “Payor’s Net Cost” and 4(e) “Maximum adjustment amount” net to zero, the support amount calculated will be incorrect. Using the below sample numbers as an example, since payor’s net cost is (-)56 and the maximum adjustment amount is 56 (-56+56 = 0), the final calculation of $370/week of child support is incorrect. The correct result should be instead $314/week. That’s a significant difference of $56/week or almost $3,000 per year!

Attorney Cheong is right when he says that explaining the details of the error would be laborious. The short analysis is this: a defect in the Guidelines Worksheet causes the medical/child adjustment to randomly drop to zero due to a calculation error. Suffice it to say that the amounts in Box 4(d) and Box 4(e) vary from case to case. These two boxes can contain positive or negative numbers, and occasionally, they will contain positive and negative numbers that perfectly offset each other, equaling zero.

As Attorney Cheong’s blog illustrates, when Box 4(d) and Box 4(e) happen to “offset” each other with positive/negative numbers that equal zero, it effectively breaks the Guidelines formula by eliminating the adjustment for medical/child care costs completely. To recap, the error we describe above affecting shared custody cases under the 2017 Guidelines inappropriately doubles the credit for medical/child costs. In contrast, the error discovered by Attorney Cheong involves the Guidelines erroneously reducing the medical/child adjustment to zero. (Read Attorney Cheong’s full blog for more details.)

It seems possible that the Trial Court could address the error identified by Attorney Cheong by adjusting the state’s official Child Support Guidelines Worksheet. However, any such change should be accompanied by a public announcement by the Trial Court, so that courts, attorneys and parties realize they need replace the defective original worksheet with a revised version. This did not happen in 2013, when the Trial Court updated the 2013 Guidelines Worksheet to correct an error, but failed to publicize the change. As a result, court staff and attorneys continued using the original defective worksheet for years, despite the availability of revised worksheet that corrected the problem.

UPDATE 10/5/2017: Fixes Reportedly Coming for Errors in Massachusetts 2017 Child Support Guidelines

PLYMOUTH, MA – A member of the Massachusetts Child Support Task Force, Hon. Kevin R. Connelly of the Plymouth Probate and Family Court, told a gathering of Plymouth County attorneys on Tuesday night that the state’s Child Support Task Force would be reconvening soon to correct errors discovered in the 2017 Massachusetts Child Support Guidelines. Attorneys are “encouraged to check their math by hand”, said Connelly, until fixes to the 2017 Guidelines have been published by the Trial Court.

Connelly told a group of attorneys at the Plymouth County Bar Association Judges Roundtable that the “Task Force will be reconvening at some level” to fix “some imperfections in the fillable [Guidelines] worksheet” that were discovered in recent weeks, after the Guidelines became effective statewide on September 15, 2017.

“Unfortunately, it did not go off without a hitch”, Connelly told onlookers. Connelly said he received an email from the Trial Court on the morning of the Round Table event. Connelly had not had time to review the email in detail at the time of the event, but said the Trial Court was informing Task Force members that revisions to the Guidelines would require the group to reform in the near future.

The Annual Plymouth County Judges Round Table, held on October 3, 2014, featured all four justices of the Plymouth Probate and Family Court, including Connelly, Hon. Lisa A. Roberts, Hon. Patrick A. Stanton and First Justice Hon. Edward G. Boyle.

UPDATE 10/6/17: More Errors in 2017 Guidelines Identified for Children Over 18 Years Old

Attorney Cheong (with help from Attorney Justin Kelsey), as well as Professor Benjamin Bailey of UMass Amherst and his wife, Attorney Julia Rueschemeyer, have identified yet another error in the 2017 Massachusetts Child Support Guidelines, this time affecting children who are over 18. Cheong describes the error as follows:

This error results in a payor paying more child support for fewer children based on the way support is calculated for emancipated versus unemancipated children. … This error is due to a multiplier error in Table B of the Guidelines.

UMass Professor Bailey indicates that the error in Table B affects every child support calculation under the 2017 Guidelines involving a mix of children over and under 18:

This means that as of September 15, 2017, every child support calculation that involves a) at least one child under 18 AND b) at least one child over 18 will give wrong results, resulting in lower child support payments than the Task Force intended. These errors are most obvious in cases where adding an additional child to the calculator LOWERS your overall support. The Task Force intended for additional children over 18 to increase overall child support, but to increase it by less than it would increase by adding a child under age 18. Instead, in four cases, it actually LOWERS the overall child support award.

The latest error involves somewhat smaller inaccuracies, at least when measured in dollars, with most errors affecting orders by less than $20 per week (and usually less than $10 per week). However, the sheer pervasiveness of this error – which potentially affects a great many child support cases statewide – presents unique problems. Unlike the shared physical custody error, or the mathematical quirk discovered by Attorney Cheong, the new error is both harder to notice and less easily fixed.

Bailey and Rueschemeyer have supplied a replacement Table B that can be used to correct the error, but users will need to pull out their calculators and do the math to make the fix work.(Indeed, one real risk is that parties will simply ignore the error because of its fairly modest impact on overall child support. However, ignoring the problem only enures that the mistake will be enshrined in a larger number of child support orders across Massachusetts.)

For those keeping track at home, the discovery of the error affecting children over 18 means that significant mistakes have now been uncovered in the two biggest changes announced in the 2017 Guidelines: the medical/child care credit and the revised calculation for children over 18. It remains difficult to understand why the Trial Court did not release the 2017 Child Support Guidelines Worksheet to the public before it became law, so individuals like Gabriel Cheong, Kelsey, Bailey and Rueschemeyer could have identified these highly correctable mistakes earlier.

h/t to Michael for spotting this issue

About the Author: Jason V. Owens is a Massachusetts divorce lawyer and Massachusetts family law attorney for Lynch & Owens, located in Hingham, Massachusetts and East Sandwich, Massachusetts.

Schedule a consultation with Jason V. Owens today at (781) 253-2049 or send him an email.